Illegal Dental Billing Fraud Exposed: How to Spot, Prevent & Protect Yourself Today

Dental billing fraud isn’t just paperwork gone wrong—it’s a calculated deception that hurts everyone. Imagine a dentist charging your insurance for a root canal you never received or an office inflating charges to squeeze extra payouts from insurers. These unauthorised benefits might seem like victimless crimes, but they’re far from it. In reality, such misrepresentation fuels a pervasive issue in the United States healthcare system, draining resources, spiking insurance premiums, and eroding trust between patients and providers. As dental spending climbs—projected to hit billions annually—every dollar lost to false claims is a dollar stolen from those needing genuine care.

The fallout is brutal. For dentists found guilty, consequences like fines, license revocation, or even imprisonment can shatter careers. Patients, meanwhile, face denied claims or surprise bills for services not rendered, leaving them financially stranded. Insurers and employers aren’t spared either: Inflated costs trickle down, driving higher premiums and straining healthcare resources. Worse, these schemes tarnish the integrity of ethical dental practices, forcing honest providers to work harder just to prove their credibility.

Stopping this crisis demands action—not just awareness. Review your Explanation of Benefits (EOB) for unusual codes or unfamiliar charges. Dental offices should practice transparency, offering itemised bills and avoiding vague terms like “miscellaneous fees.” Insurers must ramp up audits and use AI tools to detect suspicious patterns, like repeated claims for rarely needed services. If something seems off, report it to your state dental board or the National Health Care Anti-Fraud Association. Combating exploitative practices protects not just patients but the reputation of an entire industry—keeping care ethical, affordable, and genuinely focused on health.

What Is Illegal Dental Billing Fraud?

Definition

Illegal Dental billing fraud isn’t a simple mistake—it’s an intentional act of deception by unethical providers to claim unauthorised benefits from insurers or patients. Unlike honest errors or negligence, this fraud hinges on deliberate actions like billing for services not rendered (e.g., charging for X-rays you never received), upcoding procedures (billing a crown instead of a filling), or falsifying patient information to inflate unnecessary costs.

Some clinics disguise malicious intent by offering to waive deductibles or copayments, pressuring patients into unnecessary treatments under the guise of “affordability.” At its core, this abuse of the system relies on criminal intent—a calculated effort to inflate claims and exploit loopholes, draining healthcare resources meant for ethical care. Unethical billing practices, like waiving copays, often mask illegal intent

Statistics and Trends

The healthcare industry loses 3 billion annually to fraudulent dental practices, according to the National Health Care Anti-Fraud Association (NHCAA). These schemes inflate insurance premiums by 7–15

To combat fraud, insurers now deploy AI-powered systems and data mining to flag unusual patterns, like a clinic suddenly billing 50 root canals in a week. One Midwest insurer slashed fraudulent payouts by 40% after implementing such tools. But as tactics evolve, the fight to protect ethical practices grows more urgent.

What are the Key Elements of Illegal Billing?

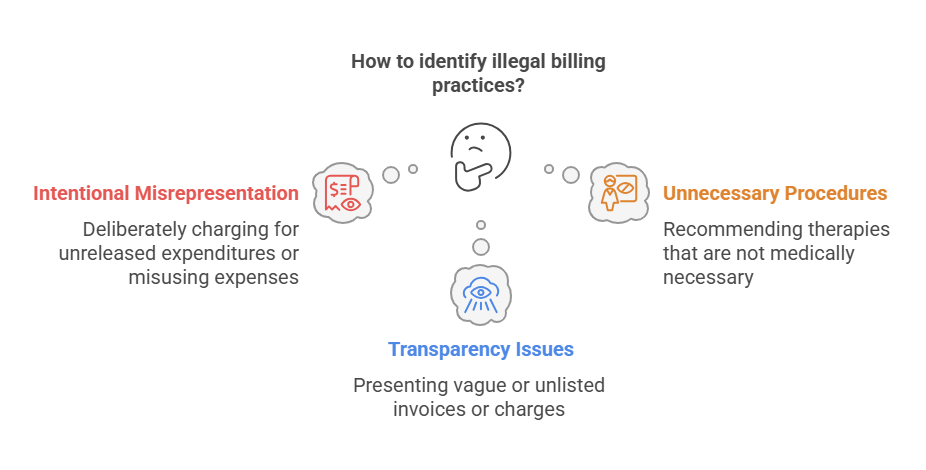

Unethical dental billing is characterised by several key elements that distinguish it from mere billing errors or abuse. Understanding these components is crucial for identifying and preventing fraudulent activities in dental care. These practices often involve intentional misrepresentation, financial gain at the expense of patients or insurers, and violations of ethical guidelines or legal frameworks. Recognising these elements can help protect patients, ensure fair reimbursement, and uphold the integrity of the dental profession.

Intentional Misrepresentation

At the core of illegal dental billing lies intentional misrepresentation—a fundamental tactic where providers falsify information to deceive patients or insurers. This includes billing for services not rendered, misrepresenting service dates, using incorrect codes, or inflating claims to secure unauthorised benefits. Unlike unintentional errors, this criminal act is deliberate, designed to exploit the system for financial gain. For example, a dentist might claim a cavity filling was a root canal, intentionally misrepresenting the procedure to justify higher payouts.

Financial Gain at the Expense of Patients or Insurers

Fraudulent billing practices prioritise the perpetrator’s financial gains over patient welfare. Tactics like upcoding procedures, unbundling services, or phantom billing create inflated costs, shifting the financial burden to patients (via higher out-of-pocket expenses) and insurers (through increased claims costs). These schemes force premiums to rise systemwide, punishing honest policyholders while lining the pockets of unethical providers.

Violation of Ethical Guidelines or Legal Frameworks

Dental billing fraud blatantly violates ethical guidelines and legal frameworks, eroding the integrity of dental practices. From breaching HIPAA protections to submitting false claims to federal programs like Medicaid, these acts defy state-specific laws and the False Claims Act. Consequences include penalties like fines, license revocation, or criminal prosecution—but the true damage is the breach of trust between dentists and patients. Ethical compliance isn’t optional; it’s the bedrock of sustainable, patient-first care.

Types of Dental Billing Fraud

Dental billing fraud can manifest in a variety of deceptive practices that result in significant financial losses for both patients and insurers. Understanding the different types of fraud helps promote transparency and maintain integrity in the industry. Whether it’s upcoding, unbundling, phantom billing, performing unnecessary procedures, or offering deductible waivers or co-pay forgiveness, these fraudulent activities exploit the system for financial gain. Each type undermines the trust patients place in their providers and inflates dental care costs across the board, forcing insurers and patients to shoulder the burden of these unethical dental billing practices

Upcoding:

Upcoding occurs when a dentist charges for a more expensive procedure than what was performed, such as billing a root canal instead of a routine cleaning. This deceptive practice deceives insurers into paying higher reimbursements, granting the provider an illegal financial advantage. Violating federal and state laws, upcoding risks severe penalties, including fines, license revocation, and reputational damage.

Unbundling:

Unbundling involves breaking down a comprehensive procedure into separate services to inflate costs. For example, billing a single, lower-cost bundled service (e.g., a dental crown) as each component (impression, lab fee, placement) billed individually creates a higher total cost. The American Dental Association (ADA) condemns this unethical practice, which exploits billing codes to overcharge patients and insurers, violating ethical standards and inviting legal repercussions.

Phantom Billing:

Phantom billing—charging for services never provided—is a blatant violation of the False Claims Act. A dentist might bill for a procedure not performed or list treatments that never occurred, leading to criminal charges, financial penalties, and loss of practice integrity. This fraud directly harms patients and strains insurers’ resources. In short, Phantom billing creates fake bills for nonexistent procedures.

Unnecessary Procedures

Some dentists perform unnecessary procedures by misrepresenting a patient’s condition or exaggerating needed treatments. This abuse of trust wastes healthcare resources, exposes patients to unnecessary medical interventions, and inflates claims purely for profit. Such deception qualifies as fraud, eroding confidence in dental care.

Deductible Waivers or Co-Pay Forgiveness

Waiving deductibles or co-payments to encourage patients into unnecessary treatments distorts the insurance system and violates federal law. This unfair practice gives dentists an illegal competitive advantage, drives up premiums for policyholders, and risks fines or license revocation for providers.

Double Billing

Double billing involves submitting claims for the same service multiple times, often by manipulating dates, codes, or descriptions to make each claim appear distinct. A serious violation of the False Claims Act, this scheme leads to hefty fines, license suspension, and potential criminal charges, draining funds meant for ethical care.

The Effects of Illegal Dental Billing

Illegal dental billing has far-reaching consequences that affect various stakeholders across the healthcare ecosystem. Healthcare fraud in dental billing impacts patients, dentists, and insurers, straining resources and undermining the integrity of the system. Addressing this pervasive issue requires a clear understanding of how fraud is affecting each group and the broader implications for the healthcare system.

Regarding Patients:

Patients bear significant financial and emotional burdens due to dental billing fraud:

Increased Insurance Premiums

Fraudulent claims force insurers to offset financial losses by raising insurance costs, passing the burden to policyholders through higher premiums. A single unethical provider can inflate regional premiums by 10–15%, punishing honest patients for crimes they didn’t commit.

Out-of-Pocket Costs for Unnecessary Treatments

Patients subjected to unnecessary procedures—like unneeded fillings or cleanings—face additional expenses and health risks from invasive treatments. These unnecessary services drain savings and expose individuals to avoidable complications, eroding faith in healthcare’s purpose.

Erosion of Trust in Healthcare Providers

Learning about fraudulent billing practices—like phantom X-rays or upcoding—erodes patient trust in dentists and the broader healthcare system. Many victims avoid necessary care due to scepticism, worsening untreated conditions and public health outcomes.

Regarding the Medical System:

The broader healthcare system also suffers from the effects of dental billing fraud:

Financial Burden on Insurance Companies

Fraudulent claims create significant financial losses for insurers, straining resources and forcing increased operational costs to manage disputes. For example, a single $500K scam can trigger months of audits, diverting funds from legitimate claims and patient support programs.

Strain on Resources for Detecting and Combating Fraud

Detecting and preventing fraud requires substantial investment in technology, personnel, and compliance measures. These costs divert resources from critical healthcare services, like subsidised care for low-income families, to clean up after deceitful providers.

Regarding Dentists:

Dentists involved in fraudulent billing practices face severe professional and financial consequences:

Legal Consequences, Including Fines and License Revocation

Dentists caught in fraudulent billing face fines, restitution payments, imprisonment, and civil lawsuits from affected parties. In 2021, a New York dentist paid $2M in restitution and lost his license after serious offenses like billing for ghost procedures.

Damage to Professional Reputation

Fraud causes irreparable damage to a dentist’s reputation, making it difficult to regain patient trust or continue practising. Even minor violations—like misusing billing codes—can trigger the loss of professional licenses and lifelong stigma in the healthcare ecosystem.

How to Spot Dental Fraud: A Step-by-Step Guide

However, identifying the warning signs is the greatest defence against being accused of fraudulent billing. Reviewing dental patient statements for accuracy is critical—our Patient Statement Services ensure transparency. Here’s what to search for:

Review Your Bill Thoroughly

Duplicate Charges

Scrutinise your bill to ensure no services are billed multiple times for the same procedure. Fraudsters often duplicate charges for cleanings or X-rays, hoping patients won’t look closely.

Unusual or Unfamiliar Charges

Question procedures or services you don’t recall receiving. Illegal dental billing thrives on vague terms like “miscellaneous fees”—identify and challenge these immediately.

Inconsistent Dates

Verify that service dates match your treatment records. A bill billed weeks after your visit signals potential fraud.

Request Itemised Statements

Breakdown of Services

Demand a breakdown where each service is listed separately with its corresponding cost. Transparency exposes inflated charges or phantom treatments.

Verification of Services

Confirm that every billed service was provided. Cross-reference with appointment notes—fraudsters bank on patients skipping this step.

Understand Your Insurance Coverage

Covered Procedures

Know which treatments are covered to avoid paying out-of-pocket costs for unnecessary work. Fraudsters exploit gaps in patient knowledge.

Explanation of Benefits (EOB)

Review your EOB from the insurer to ensure it aligns with your bill. Discrepancies? Report them immediately.

Compare Treatment Plans

Second Opinions

Seek a second opinion if a treatment plan seems overly extensive or expensive. Ethical dentists welcome verification.

Treatment Records

Compare your treatment records with the billing statement to ensure they match. Mismatched codes or dates are red flags.

Look for Patterns in Claims

Monitoring Billing Patterns

Regularly check for recurring or unusual charges in bills—like sudden claims for multiple root canals. Illegal dental billing often repeats scams.

Analysing Claims History

Review past claims to identify anomalies or inconsistencies. A history of identical charges across visits suggests systemic fraud.

Preventing Dental Billing Fraud: How to Guard Yourself

To effectively prevent dental billing fraud, both patients and dental practices need to implement proactive strategies that focus on fraud protection and maintaining transparency. Dental practices should prioritise compliance with all legal and ethical standards, ensuring their billing procedures align with industry regulations. Empowering patients through education and open communication about billing processes helps them recognise potential issues early, preventing costly fraud. Implementing fraud prevention strategies like regular audits, maintaining clear records, and promoting compliance can protect dental practices from fraud while also safeguarding patients. By establishing a culture of transparency, dentists can uphold their practice’s integrity while also offering an additional layer of patient protection. Ultimately, maintaining compliance and ensuring transparent billing practices will shield both patients and providers from the impact of dental fraud. Regularly auditing your billing processes, such as our Revenue Cycle Management (RCM) services, can prevent costly errors. Fortunately, there are practical steps you may take to safeguard yourself from unlawful invoicing practices:

Educate Yourself About Common Billing Codes Used in Dentistry

Understanding Current Dental Terminology (CDT codes)—the standardised codes for dental procedures—is critical to spotting discrepancies in your bills. Familiarise yourself with codes tied to the treatments you receive, and verify that they match the services billed. For example, code D1110 represents a routine cleaning, while D2740 is a crown. Regular updates to these codes ensure accuracy, so cross-check them annually. This knowledge helps you flag potential fraud, like a simple filling billed as a pricier root canal (D3348).

Use Online Tools or Apps to Track Your Insurance Claims in Real Time

Leverage electronic claim status checks via insurer platforms or apps to monitor your insurance claims in real time. These online tools let you track the status of billed services, compare them to your treatment records, and spot unusual charges instantly. For instance, if a cleaning appears as a surgical extraction, you’ll catch it early. This streamlines the process, reduces manual errors, and fosters open communication with your dentist and insurance provider. Always review bills against your Explanation of Benefits (EOB) to safeguard against fraud.

Additional Strategies for Prevention

Regular Audits

Conduct regular audits of your billing statements to detect inconsistencies like duplicate charges or potential fraud early. A monthly review of claims can reveal patterns, such as repeated billing for X-rays you didn’t receive.

Secure Financial Systems

Clinics should implement secure financial systems with strict access controls and encryption to protect sensitive patient information. For example, limit billing software access to authorised staff only, reducing risks of data tampering.

Training and Compliance

Ensure dental staff receive annual training on ethical billing practices and compliance with HIPAA and state-specific laws. Role-playing fraud scenarios can reinforce accountability and legal adherence.

Select Reputable Suppliers

Choose reputable dental billing software updated to reflect the latest coding and billing regulations. Trusted vendors reduce errors and automatically flag outdated codes, protecting both patients and practices.

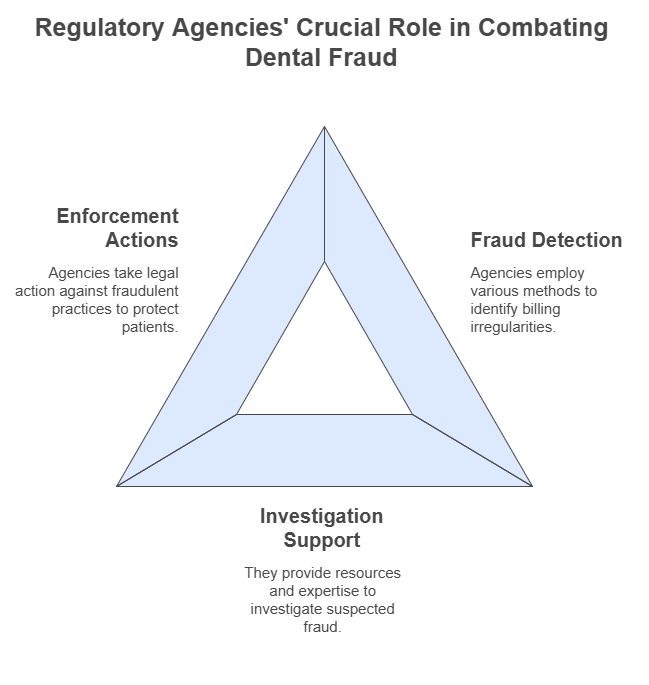

Reporting Dental Billing Fraud: The Role of Law Enforcement

Protecting the healthcare system from dental fraud requires reporting suspicious activity—a crucial step in maintaining integrity, protecting patients from financial harm, and holding unethical providers accountable. Below’s how to act:

Document Suspected Fraud Effectively

Start by gathering detailed documentation: secure copies of bills, invoices, and statements showing billing discrepancies. Record conversations with dentists or staff, save emails and correspondence with the dental practice or insurance company, and verify treatment records against services billed. For example, if your bill lists a crown, but your treatment records mention only a cleaning, this mismatch is vital evidence.

Contact Law Enforcement or Regulatory Bodies

File complaints with State Dental Boards or the National Association of Insurance Commissioners (NAIC) via their complaint form. For national-level issues, the National Health Care Anti-Fraud Association (NHCAA) offers resources to escalate healthcare fraud cases. These regulatory bodies investigate illegal practices, enforce disciplinary measures (like license suspension), and collaborate with enforcement agencies on fraud investigations.

Reporting Mechanisms Through Insurance Providers

Most insurers provide fraud hotlines or online forms for reporting suspicious activities. Submit detailed information, including dates, amounts, involved parties, and EOB statements highlighting discrepancies between billed and actual care. By alerting your insurer to potential fraud, you trigger audits that protect others from similar dental insurance fraud.

Legal Consequences for Dentists Engaged in Billing Fraud

Engaging in dental billing fraud exposes dentists to severe legal consequences that can devastate both their professional careers and personal lives. Violating healthcare laws and healthcare regulations not only results in financial penalties but also undermines the trust patients place in healthcare providers. Maintaining compliance with billing practices is crucial to avoid facing penalties that can include fines, imprisonment, and damage to one’s professional reputation.

Fines Under the False Claims Act (FCA)

Dentists guilty of submitting false claims to government programs like Medicare or Medicaid face significant fines under the False Claims Act (FCA). For each fraudulent claim, providers must repay overpayments plus civil penalties. Dentists guilty of submitting false claims to government programs like Medicare or Medicaid face significant fines under the False Claims Act (FCA). For each fraudulent claim, providers must repay overpayments, plus civil penalties of

11,000 per false claim and damages equal to triple the amount suffered by the government. In 2023, a Florida dentist paid 2.8M in restitution after billing Medicaid for services not rendered—a stark reminder that compliance with federal law isn’t optional.

Criminal Charges Leading to Imprisonment

Dental billing fraud can escalate to criminal charges, including felony convictions and imprisonment for up to five years. Individuals face criminal fines up to

250,000, while organisations may pay 250,000, while organisations may pay 500,000 per violation. A 2022 case saw a Texas dentist sentenced to 3 years in prison for fraudulent claims totalling $1.5M—proof that engaging in fraud risks both freedom and finances.

Loss of Professional Licenses and Certifications

Fraud triggers license revocation by state dental boards, barring dentists from practice permanently. For example, a New York provider lost his license after permanent exclusion from federal programs like Medicare—a devastating blow to his career. Even beyond financial losses, the damage to professional reputation makes rebuilding trust nearly impossible, with many facing insurmountable career limitations.

File a complaint with the National Health Care Anti-Fraud Association (NHCAA) to escalate unresolved cases.

Strategies for Ethical Billing in Dentistry

Implementing ethical billing practices in dentistry is crucial for maintaining patient trust and ensuring compliance with legal standards. It fosters a culture of transparency, where both patients and dental practices benefit from clear, honest interactions regarding bills and services rendered. By adhering to these ethical strategies, dental professionals can reduce the risk of discrepancies or fraud and strengthen relationships with patients, promoting loyalty and satisfaction. Creating an environment that prioritises fairness and integrity helps build a foundation for long-term success, where patients feel valued, understood, and confident in the billing system.

Case Studies: Building Patient Trust

A California dental practice saw a 40% increase in patient retention rates after adopting transparent billing processes, including detailed explanations of bills and open communication about costs. By encouraging questions and providing itemised statements, they fostered long-term relationships rooted in fairness and integrity. Patients reported higher satisfaction, proving that ethical billing practices aren’t just about compliance—they’re a cornerstone of patient trust and loyalty.

Best Practices for Creating a Culture of Compliance

Start with training staff on billing regulations to reduce errors and flag discrepancies early. Conduct ethical audits quarterly to ensure accuracy and transparency, using technology like AI-driven software to detect anomalies in claims. Partner with legal consultation experts to stay updated on healthcare law and standards, minimising risks of illegal practices. For example, one clinic cut billing disputes by 60% by integrating real-time compliance checks and educating patients about their bills. A proactive approach to legal requirements protects your practice’s reputation while aligning with ethical and legal billing practices.

Ethical vs. Unethical Dental Billing Practices

Ethical dental billing practices serve as the backbone of a trustworthy and compliant healthcare environment, ensuring transparency, accuracy, and protection of patient trust. Every charge must accurately reflect the services delivered and align with the professional standards that guide the dental profession. This includes obtaining informed consent, clearly explaining costs, and following legal guidelines to prevent misunderstandings and avoid financial harm to patients.

In contrast, unethical practices—such as upcoding procedures to inflate reimbursement, unbundling bundled services to increase charges, or billing for services not rendered—constitute deceptive actions that undermine ethical billing. These unethical behaviours not only inflate healthcare costs but also expose dental providers to serious legal penalties and reputational damage. Maintaining ethical billing practices is not optional; it’s essential for preserving integrity within the profession, protecting the rights of patients, and ensuring that dental care remains centred on quality, honesty, and accountability.

Emerging Trends in Combating Dental Billing Fraud

As dental billing fraud continues to evolve, innovative solutions are emerging to combat fraudulent activities and improve accuracy and transparency in the industry. These emerging trends leverage technology to enhance existing systems, providing better ways to detect, prevent, and resolve fraud. With increasing reliance on automation and data analytics, dental practices are now embracing cutting-edge tools that improve fraud detection and protect patients and insurers alike. By integrating these technologies, the fight against dental billing fraud is transforming, making it more efficient and effective than ever before.

AI-Powered Billing Software That Detects Anomalies in Claims

Artificial intelligence (AI) is revolutionising the fight against dental billing fraud. AI-powered software analyses large datasets from claims to identify patterns and anomalies, such as sudden spikes in expensive procedures or duplicate billing codes. For example, one platform flagged a clinic billing 30 crowns in a week—far exceeding regional averages—prompting a manual review that uncovered fraudulent activities. By automatically flagging suspicious claims, these tools reduce fraudulent payments while ensuring compliance with regulatory standards, protecting both patients and insurers from financial losses.

Blockchain Technology for Secure and Transparent Recordkeeping

Blockchain creates immutable records of patient treatments and billing information, making it nearly impossible for fraudsters to alter or manipulate data. Each transaction is traceable and tamper-proof, enabling efficient audits and real-time verification of claims. A Midwest dental network cut billing disputes by 45% after adopting blockchain, as insurers could instantly validate transactions. This transparency not only deters fraud but also builds trust with patients, who gain visibility into every charge tied to their care.

Role of Telehealth in Reducing Opportunities for Fraud

Telehealth platforms minimise fraud risks by digitising patient interactions and creating a digital trail of remote consultations. Secure communication channels and digital documentation ensure only legitimate services are billed, reducing phantom billing scams. For instance, a teledentistry provider saw a 60% drop in suspicious claims after implementing security measures like timestamped treatment notes and encrypted records. By verifying claims in real time and safeguarding patient data, telehealth addresses vulnerabilities inherent in traditional in-person visits, reducing opportunities for exploitation.

Real-Life Case Studies

Benevis LLC and Kool Smiles Dental Clinics

In January 2018, Benevis LLC and its affiliated Kool Smiles Dental Clinics agreed to a $23.9 million settlement with the U.S. Department of Justice and participating states after allegations of false claims to Medicaid. The scheme involved billing for medically unnecessary dental services, including pulpotomies (baby root canals) and tooth extractions on children—many of whom never received the procedures. Detection & Investigation: The fraud was first exposed through whistleblower reports from former employees, prompting a joint federal investigation by the U.S. Department of Justice and state agencies. Investigators reviewed billing records, conducted interviews with patients and staff, and uncovered systemic fraudulent activities targeting vulnerable populations. Resolution & Lessons: The financial penalty mandated transparency reforms in billing practices and stricter oversight by agencies. This case underscores the critical role of whistleblower intervention in fraud detection, the need for robust state-level fraud investigations, and the ethical duty to protect vulnerable patients from predatory dental service fraud. It also highlights how accountability mechanisms, like audits and staff training, can prevent fraudulent dental billing and safeguard Medicaid resources.

FAQS About Dental Billing Fraud

How can I verify if my dentist is licensed and reputable?

Check your dentist’s credentials by confirming their license status through your state dental board or the ADA database. Review platforms like Health Grades or Vitals for patient feedback and ensure they have a valid license with no disciplinary actions. Always consult professional directories to verify their standing before scheduling care.

What should I do if my insurance provider denies my claim due to suspected fraud?

Request a detailed explanation for the denial and compare your billing statement with treatment records. If you spot discrepancies, resolve them with your dentist first. For unjustified denials, consult legal advice to challenge the insurer and protect your rights.

Are there legal protections for whistleblowers reporting dental fraud?

Yes. The False Claims Act offers protection for whistleblowers, including anti-retaliation measures and incentives (a portion of recovered funds). If you report fraud involving government programs like Medicaid, you’re shielded legally while holding wrongdoers accountable.

What is overbilling in dentistry?

Overbilling involves charging patients or insurers for unnecessary or unperformed services at inflated rates. Common tactics include upcoding (billing complex procedures for simple ones) and unbundling (breaking bundled services into pricier individual charges).

Can I sue my dentist for fraud?

Yes. If you uncover fraudulent billing practices, consult a legal professional to assess your case. Successful lawsuits may recover losses and penalise the dentist, but ensure you have documentation (e.g., billing statements, treatment records) to support your claim.

Does the Surprise Billing Act apply to dental?

The federal Surprise Billing Act primarily covers medical services, but some states have enacted laws to protect patients from unexpected dental bills. Always check local regulations to understand your rights against surprise charges.

Can you be sued for unpaid dental bills?

Yes. Dentists or collection agencies can take legal action for unpaid bills. To avoid escalation, communicate with your provider or insurer to resolve disputes early. If the bill stems from fraudulent billing, challenge it legally instead of paying.

What are upcoding and unbundling?

Upcoding and unbundling are deceptive billing practices in the dental industry. Upcoding occurs when a dentist bills for a more expensive service than the one actually provided, while unbundling involves separating procedures that should be billed as one service into multiple charges. Both practices lead to inflated bills for patients and insurers and can result in significant financial harm. These actions violate compliance regulations and ethical healthcare standards. To learn more about these practices, refer to the sections on upcoding and unbundling in our article.

Can dentists commit insurance fraud?

Yes, dentists can commit insurance fraud by engaging in activities like upcoding, unbundling, or falsifying treatment records to increase reimbursement. Dental insurance fraud can lead to severe financial losses for insurers and patients, and legal consequences for the dentists involved. Dentists who participate in fraudulent practices may face disciplinary action from regulatory bodies, criminal charges, and loss of their professional license.

What is dental insurance fraud?

Dental insurance fraud involves dishonest practices by dental professionals, patients, or insurance providers to gain unauthorised benefits or payments. Examples include billing for treatments not provided, falsifying treatment records, or submitting claims for non-covered services. Fraudulent billing not only impacts patient care and insurers but also raises the cost of dental coverage for everyone. It’s essential to report any suspicious activity to insurance providers or regulatory bodies to ensure the integrity of the healthcare system.

Final Thoughts: Promoting Dental Billing Transparency

Promoting transparency in dental billing is a collective responsibility demanding vigilance and commitment from all stakeholders—patients, dentists, and insurers. For patients, understanding dental coverage details and questioning unclear charges reduces opportunities for fraud. Dentists must prioritise ethical practices, adhering to legal standards through regular auditing of discrepancies and adopting robust systems to flag suspicious claims. Insurers play a pivotal role by investing in automation to detect anomalies and enforcing compliance regulations, minimising financial losses while boosting customer satisfaction. Regulatory bodies amplify these efforts during fraud prevention month and beyond, addressing waste of healthcare resources and safeguarding patient safety. A collaborative effort—rooted in technology, open communication, and shared accountability—strengthens trust and ensures quality care. By rooting out deceit, we protect patient care, uphold ethical healthcare, and transform billing from a source of conflict into a pillar of integrity.

The days of having to endure risky dental care, when you may be confronted with unfinished procedures or caught engaging in unlawful dental billing methods, are long gone. You can ensure that you receive fair and moral treatment if you stay alert, challenge everything, and report any questionable action. For clinics needing end-to-end support, explore our healthcare accounting services to maintain financial transparency.

NOTE: This article’s ideas are those of the author and may not represent the organisation’s viewpoints. This will help us spread the news and start the process of improving their dental care and transforming their lives.

Dental Billing Fraud Checklist: Protect Yourself Today

- Look for any unidentified charges on your bill.

- Request an itemised statement in writing.

- Compare your insurance EOB with your bill.

- Ask about any charges that don’t make sense.

- Inform the dentistry board or your insurance provider if you believe there has been foul play.

To avoid unethical dental billing tactics and receive the services you are entitled to, keep an eye on your dental bills and heed these suggestions. Join me in promoting openness and compassionate care in dentistry.

Hello! I hope you’re having a great day. Good luck 🙂

Hello! yes, Thankyou 🙂