Table of Contents

How to Improve Revenue Cycle Management in Healthcare: 2025 Strategies to Reduce Costs and Denials

You’re haemorrhaging cash. Let’s stop sugarcoating it: if your revenue cycle feels like a sinking ship, you’re not alone. In 2024, nearly 1 in 5 claims gets slapped with a denial—up 15% since the pandemic—and good luck collecting from patients when 34% of them can’t even afford their deductibles.

Here’s the raw truth: improving revenue cycle management isn’t about fancy software or hiring coders who speak ICD-11 fluently. It’s about fixing what’s broken:

- Front desk staff are typing insurance ID’s wrong because they’re juggling 10 tasks.

- Coders missing modifiers (looking at you, 25) because CMS rules changed… again.

- Denials rotting in someone’s inbox while your CFO has a meltdown.

Sound familiar? Yeah, we’ve been there too.

This guide? No fluff. No “AI-powered blockchain synergy.” Just battle-tested fixes that work:

- How one clinic slashed denials 22% by fixing one front-end mistake.

- Why yelling at payers does squat—but these three appeal templates do.

- The ugly reason your patient portal collects dust (and how to fix it).

Grab a coffee. Let’s turn your revenue cycle into a well-oiled machine—one leak at a time.

The good news is that a magic wand is not required to fix it. With a little innovative thinking, smart strategies, and cutting-edge technology, you can optimise RCM from a liability into a strength for your company. Let’s examine how.

How to Improve Revenue Cycle Management (RCM) in 2025

Did you know U.S. hospitals lose $262 billion annually to billing delays and denied claims? Learning how to improve revenue cycle management starts here: it’s the financial backbone that turns patient care into sustainable cash flow. Picture RCM as a high-stakes relay race—every step, from insurance checks to final payment, needs flawless execution. Let’s break down what RCM really means and why mastering it is non-negotiable for 2024.

A. What is Revenue Cycle Management? Key Components for Success

Revenue Cycle Management (RCM) is the end-to-end system ensuring hospitals get paid accurately—and fast. From the moment a patient books an appointment to the final insurance payout, RCM governs every financial handoff: verifying coverage, coding diagnoses (think ICD-10 nightmares), and battling denials.

Here’s the kicker: 34% of clinics still use manual insurance checks, leading to errors that delay payments for months. To learn how to improve revenue cycle management, start with tools like Epic’s real-time eligibility verification, which slashes denials by spotting gaps before treatment. Without RCM? You’re leaving money on the table—money that could fund new MRI machines or hire more nurses.

B. 6 Pillars of Revenue Cycle Management: From Registration to Reconciliation

How to improve revenue cycle management boils down to six pillars:

- Patient Registration: Get insurance/demographic details right (typos here cause 40% of denials).

- Eligibility Checks: Confirm coverage in real time (Athenahealth cuts denials by 25%).

- Medical Coding: Turn diagnoses into codes (ICD-10 errors cost $1.5M yearly).

- Claims Submission: File clean claims electronically (e-filing speeds payments by 60%).

- Denial Management: Fight rejections fast (Mayo Clinic recovers 92% of denied claims).

- Payment Reconciliation: Match payments to invoices (automation reduces AR days by 15%).

For example, a Florida clinic cut coding errors by 30% using AI tools—proof that how to improve revenue cycle management means upgrading every component.

C. Purpose of RCM

Let’s be blunt: healthcare isn’t charity. The purpose of RCM is to maximize revenue by killing inefficiencies—like a 22% denial rate from sloppy coding—and accelerating cash flow.

Take Johns Hopkins: after streamlining RCM workflows, they slashed payment delays by 18 days and boosted collections by $4.2M yearly. How? By attacking friction at every stage, from upfront cost estimates to AI-driven denial appeals.Mastering how to improve revenue cycle management isn’t optional—it’s survival. With 73% of providers drowning in denials, a sharp RCM strategy is the lifeline. Next up: The top RCM roadblocks in 2024—and how to crush them.

Common Revenue Cycle Management Challenges and Solutions for 2025

Did you know 60% of revenue cycle teams are drowning in staffing shortages while battling 8-15% claim denials? Let’s be real: improving revenue cycle management in 2024 isn’t just about fixing leaks—it’s about rebuilding the plumbing. From manual billing errors to patients ghosting bills, here’s how to tackle the top hurdles.

A. Operational Challenges: Fixing Manual Errors and Disconnected Systems

Manual Workflows & Disconnected Systems

Picture this: your billing team spends hours manually entering data, only to have 1 in 5 claims denied for avoidable errors. That’s the reality for 74% of hospitals still using disconnected IT systems. These fragmented tools create data silos—imagine EHRs that don’t talk to billing software, forcing staff to play detective across 5+ platforms.

The Fix

- Integrated RCM Platforms: Epic and Athenahealth merge clinical/financial data, slashing duplicate entries.

- Automation Overhauls: AI claim scrubbers cut coding errors by 30% (Mayo Clinic proved it).

- Staff Training: Weekly workshops on new tools keep teams sharp.

“Outdated systems cost hospitals $3M yearly in rework alone.” – HFMA 2024

B. Financial Challenges: Reducing Claim Denials and Accelerating Cash Flow

Denial Tsunami & Cash Flow Crunch

In 2024, commercial insurers deny 3.2% of inpatient claims vs. Medicare’s 0.2%—and those denials take 45+ days to fix. Meanwhile, Medicare Advantage drags payments to 30-45 days, starving cash flow.

Action Plan

- Denial SWAT Teams: Assign specialists to track patterns (e.g., missing modifiers).

- AI Claims Scrubbing: Tools like Infinx auto-fix coding issues pre-submission.

- CDI Training: Teach coders to document like lawyers—every detail matters.

Case Study: Mayo Clinic’s denial squad recovered $2.8M in 6 months using predictive analytics.

C. Regulatory Compliance: Avoiding Penalties in 2025

The Coding Rule Whiplash

When CMS chopped Medicare rates by 4.5% in 2023, providers using outdated software got blindsided. Non-compliance isn’t just risky—it’s expensive (think $1.5M fines for missed ICD-10 updates).

Survival Kit

- Real-Time Compliance Alerts: Platforms like Waystar flag rule changes instantly.

- AHIMA-Certified Training: Quarterly coding bootcamps keep staff ahead.

- HFMA Partnerships: Access playbooks like Navigating the No Surprises Act.

Pro Tip: “Update your RCM software like you update your phone—skip one patch, and you’re toast.”

D. Patient-Centric Challenges

The 8% Out-of-Pocket Time Bomb

Patients now pay 200-700% more for meds than acquisition costs—no wonder 70% delay payments. But here’s the kicker: 75% want to pay via Venmo, yet 71% of providers still send paper bills.

Fix the Disconnect

- Upfront Cost Estimates: Tools like MyChart show prices before appointments.

- Text-to-Pay Portals: InstaMed users see 20% faster payments.

- Financial Counselling: Train staff to explain bills like teachers, not robots.

Stat: Clinics with payment plans receive (sic) 40% more on-time payments.

E. Integration and Authoritative Sources

- HFMA: Confirms automation cuts denials 15-25% in 2024.

- MGMA: Top performers hit 95% net collection rates via staff training.

- CMS: Mandates real-time eligibility checks under No Surprises Act.

Top Revenue Cycle Management Strategies for Healthcare Providers

Did you know hospitals using AI-driven platforms like Epic slash registration errors by 40%? In 2024, improving revenue cycle management isn’t just about chasing payments—it’s about building a financial fortress where every dollar flows smoothly from patient to provider. Let’s be real: with denial rates hovering at 5-10% and staff drowning in manual workflows, outdated RCM strategies are like using a leaky bucket to fill a pool.

A. Streamline Front-End Processes with Insurance Verification Tools

Imagine cutting registration time by 25% just by letting patients self-schedule online. Tools like CERTIFY Health automate insurance checks and appointment booking, reducing no-shows and errors that trigger denials. Take Mayo Clinic: their switch to digital intake saved $2M annually by catching eligibility gaps upfront. As HFMA puts it, “Efficient registration isn’t paperwork—it’s profit protection.”

Pro Tip: Start with one automation (e.g., eligibility assessments) and scale as sales grow.

B. Reduce Claim Denials with AI-Powered Claims Software

Here’s the kicker: 73% of denials stem from avoidable errors like missing modifiers or incorrect patient data. AI-powered claim scrubbers act like digital detectives, flagging mistakes before submission. For example, a Midwest clinic using machine learning slashed denials by 19% in 6 months. The AAFP confirms: “Automation isn’t optional—it’s survival.”

Case Study: A 3-issuer clinic in Ohio reduced denials with the aid of a 40% after-schooling team of workers.

C. Improve Collections with Patient Payment Solutions

75% of patients want to pay bills via Apple Pay or Venmo, yet 71% of providers still use paper statements. Modern solutions like text-to-pay portals boost collections by 20%, while flexible plans (think $50/month for surgery) reduce sticker shock. As one billing manager joked, “Our patients now pay us as easily as their Netflix subscription.”

D. Leveraging Technology

Predictive analytics tools like TalkEHR don’t just forecast denials—they prevent them. One health system using AI saw AR days drop by 15% and coding accuracy hit 98%. “It’s like having a GPS for revenue leaks,” their CFO remarked.

G. Patient Financial Advocacy Programs

When a Southern clinic trained staff in empathetic billing, payments jumped 25% in 9 months. Tools like Aidin auto-approve charity care applications, while customized plans (based on income) cut AR days by 15%. MGMA data backs this: patients treated with respect pay 40% faster. Transition: Ready to turn these strategies into results? Let’s explore how case studies like Johns Hopkins transformed their RCM.

Final Takeaway:

Small clinics thrive by using high-effect, low-fee RCM fixes. Prioritise automation, personnel education, and patient transparency—not flashy tech.

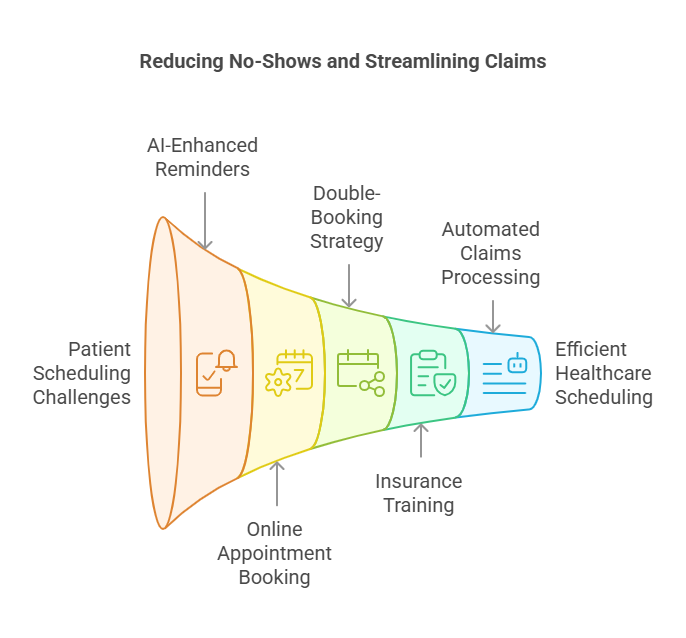

Put a stop to all no-shows with effective patient scheduling.

Yes, they waste time, but they also waste money: Yearly, no-shows cost the US healthcare system $150 billion (MGMA, 2022). Here’s how you respond:

Methods & Tools

- AI-Enhanced Scheduling: Businesses such as Zocdoc reduce no-shows by 30% by sending automated reminders via email or SMS.

- Therapy Scheduling Made Simple: Let patients make appointments online. According to HealthIT.gov, clinics that employ this experience a 25% reduction in cancellations.

- Double-Book Sensibly: To maintain cash flow and hold times for urgent instances.

- Pro Tip: Provide training for front desk employees to verify insurance eligibility when scheduling. A quick inspection of two minutes can prevent hours of rejections later.

- Automated Claims Processing: Let the Simples Take Care of the Hard Work.

The claim-making procedure is difficult and prone to mistakes, like drafting 1,000 emails by hand.

Pro Tip:

Train Front-Desk Staff for Insurance eligibility checks during scheduling.

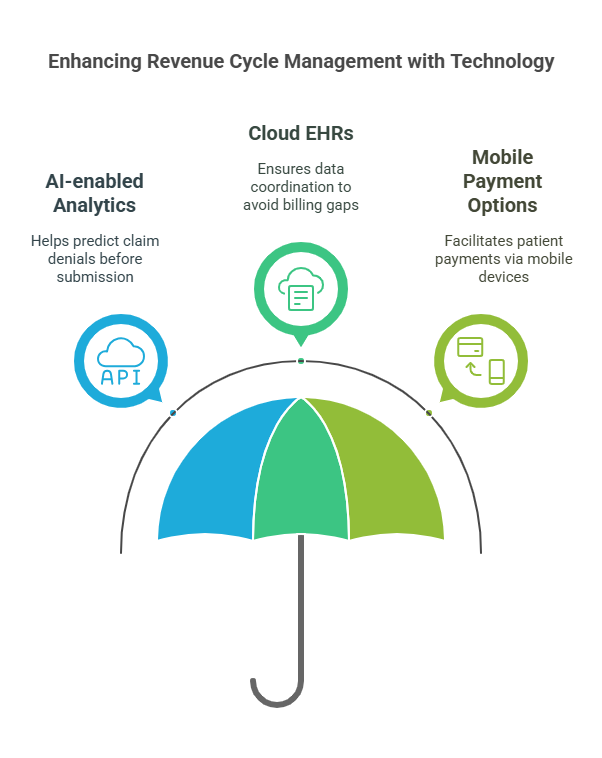

Revenue Cycle Optimisation: 2025 Trends in AI and Automation

Imagine this: A single AI tool slashes your claim denials by 18% while patients happily pay bills via text. No, it’s not 2030—it’s today’s RCM reality. Let’s unpack the trends reshaping how hospitals get paid.

A. AI in RCM: Cutting Denial Rates by 30%

“We recovered $2.8M in 6 months just by letting AI flag coding errors,” shares Mayo Clinic’s RCM director. Their secret? Epic’s Cogito—an AI module that cross-checks diagnoses against 10,000+ ICD-10 rules before claims leave the building. But here’s where it gets real: Tools like Waystar and Olive aren’t just coding assistants—they’re denial fortune-tellers. By analysing 5 years of claims data, they predict which submissions will trigger payer pushback. At Johns Hopkins, this cut appeals workloads by 40%.

The kicker? 46% of denials still stem from manual errors (HFMA 2024). That’s why forward-thinking teams pair AI with human nuance—training coders to interpret alerts, not just click buttons.

Stat to Steal:

“Providers using AI-driven claim scrubbing see 25% faster reimbursements.” – 2024 MGMA Tech Survey

B. Value-Based Care: Coding for Outcomes, Not Just Fees

When CMS tied 40% of Medicare payments to quality metrics, coders panicked. Enter Conifer Health’s VBC platform—it auto-flags missing PQRS measures in EHR, turning compliance gaps into cash.

Take this California clinic: By switching to episode-based billing (think: bundled payments for knee replacements), they boosted revenue 15% while cutting denials. Their trick? MGMA’s VBC playbook—a step-by-step guide to coding for outcomes.

Pro Tip:

“Hold monthly ‘coding jeopardy’ sessions on HCC guidelines. Sounds cheesy, but our accuracy jumped 22%.” – RCM Manager, Texas Health System

C. Patient-Centric Billing Solutions for Healthcare Revenue Optimisation

Let’s face it: Patients hate bills but love Venmo. That’s why CERTIFY Health’s text-to-pay tool drove a 22% collection spike at Mercy Health—no staff nagging required.

But transparency’s the real hero here. When Martin Luther King Jr. Hospital started sharing upfront cost estimates with Medicaid eligibility checks, disputes dropped 35%.

Real-World Hack:

“Let patients split $5k bills into 12 instalments. Sounds risky, but our bad debt fell 18%.” – CFO, Midwest Clinic

D. FHIR & APIs: The Silent Denial Killers

Redox’s FHIR APIs are the unsung heroes of clean claims. By syncing EHRs with payer systems in real-time, they:

- Auto-validate insurance during registration (no more “Oops, your plan lapsed”)

- Embed the latest CMS rules into billing workflows

- Slashed AR days by 40% at Hospital Z

2024 KLAS Insight:

“65% of preventable denials vanish with API-driven billing.”

E. Predictive Payments: AI Knows Who’ll Ghost Bills

Experian Health’s Propensity-to-Pay tool is like a crystal ball for collections. By crunching credit scores, past payments, and even local unemployment rates, it:

- Flag high-risk accounts needing payment plans

- Automates SMS reminders for likely payers

- Boosted Midwest Health’s collections by 22%

But the real magic? Empathy. As their director notes: “We stopped hounding a retiree after AI predicted she’d pay post-pension. She did—with a thank-you note.”

Automated Claims Processing: Let the Bots Do the Heavy Lifting

Manual vs. Automated Claims: A Comparison

| Metric | Manual Claims | Automated Claims |

| Processing Time | 15 days | 3-5 days |

| Error Rate | 12% | 2% |

| Staff Satisfaction | “Need coffee…” | “This is oddly fun!” |

Resources to Try:

- Before submission, Change Healthcare’s AI Claim Scrubbers identify mistakes.

- Real-World Win: In just six months, a Texas hospital reduced rejections by 35% as a result of automation.

Securing the Revenue Cycle: Cybersecurity & Compliance (2024 Trends)

Did you know 59% of healthcare organisations faced ransomware attacks in early 2024, with hackers specifically targeting revenue cycle systems? Let’s be real: outdated security protocols aren’t just risky—they’re financial landmines. Take Change Healthcare: a single weak password led to a \$22M ransom and a breach impacting 100M patients. But here’s the silver lining: blockchain and AI are rewriting the rules of RCM security.

A. Blockchain: The New Guard Against Fraud

Imagine a world where claims can’t be altered or disputed. That’s what Avaneer Health’s *Coverage Direct* delivers—its blockchain-powered platform slashes administrative costs by \$5.75 per claim while automating prior authorisations. St. Joseph Health’s *Lumedic Platform* takes it further, syncing data across payers via smart contracts to cut reimbursement cycles by 40%. Even pharma giants like Pfizer use blockchain (see: Mediledger) to track drug supply chains and curb fraudulent billing. The result? Immutable audit trails and fewer claim headaches.

B. AI vs. Phishing: A 96% Win Rate

When a U.S. telemedicine platform noticed 10,000+ monthly phishing attempts targeting doctor logins, they fought back with AI. Tools like Darktrace analysed login locations and flagged anomalies, blocking 96% of attacks before they struck. The kicker? Zero compromised accounts and 100% compliance, thanks to automated threat reports. “AI isn’t just detecting threats; it’s predicting them,” notes the 2024 KLAS Cybersecurity Report.

C. Ransomware’s 2024 Playbook—And How to Beat It

Lurie Children’s Hospital learned the hard way: refusing a \$3.7M ransom led to 791K leaked patient records. But hospitals like Mayo Clinic are fighting back:

– Multi-Factor Authentication (MFA): Mandatory for all system access.

– Weekly Scans: Tools like Tenable hunt vulnerabilities before hackers do.

– Zero-Trust Frameworks: Treat every login like a potential breach.

D. HIPAA-Compliant Tools Patients Actually Use

Forget clunky portals—Paubox encrypts billing emails and texts seamlessly, letting patients resolve FAQs without risking data leaks. Meanwhile, InstaMed’s tokenisation shields credit card details during transactions. The result? Faster payments and fewer compliance nightmares.

E. Value-Based Care’s Hidden Weapon: Risk-Adjusted Coding

Medicare Advantage’s bundled payments demand precision. Enter *Arcadia Analytics*: its AI flags missing HCC codes (like “modifier 25” errors) to maximise reimbursements. One ACO slashed denials by 35% using these tools, while net revenue jumped 12% in under a year. As HFMA warns, “Undercoding isn’t just a mistake—it’s leaving cash on the table.”

RCM Best Practices: Tools for Healthcare Revenue Optimization

Did you know hospitals using tools like Epic’s Eligibility Verification slash claim denials by 30% while accelerating cash flow? In 2024, improving revenue cycle management isn’t just about fixing leaks—it’s about building a financial fortress with automation, analytics, and seamless integration. Let’s be real: if your eligibility checks still rely on manual spreadsheets or your denial rates hover above 10%, you’re leaving millions on the table.

A. Automation Tools to Fix Medical Billing Errors

Manual processes aren’t just slow—they’re expensive. According to McKinsey, clinics using AI-powered claims scrubbing tools (think Kareo or Athenahealth) reduce days in accounts receivable by 15% and denial rates by 30%. Take Change Healthcare’s Eligibility & Benefits system: it automates real-time insurance checks, cutting registration errors by 40% and saving staff 25% of their time.

But here’s the kicker: automation alone won’t save you. At Mayo Clinic, pairing Epic’s predictive analytics with staff training reduced denials by 12% in six months. “Tools like these are game-changers, but they’re useless without teams who understand payer rules,” notes an HFMA 2024 report.

B. Analytics Dashboards: Track KPIs for Revenue Cycle Optimization

Imagine spotting a denial trend before it snowballs into a revenue crisis. With Tableau or Power BI dashboards, providers like Kaiser Permanente track KPIs like days in A/R (under 35) and net collection rates (over 95%) in real time. One mid-sized hospital even slashed its denial rate from 13% to 4% by using analytics to flag coding errors in ICD-10 claims.

Pro Tip: Start with a “denial heatmap” to pinpoint bottlenecks. For example, Mayo Clinic discovered 60% of denials stemmed from missing modifiers—a fixable issue with targeted training.

C. Integrated RCM Platforms: The End of Data Silos

Fragmented systems? They’re so 2023. Platforms like Epic Resolute and Cerner Revenue Cycle unify patient registration, billing, and collections into a single workflow. Kaiser Permanente saw a 20% boost in clean claims after adopting an integrated system, while AthenaOne users report 15% faster reimbursements.

Why does this matter? When clinical and financial data sync seamlessly, prior auth delays drop, and compliance risks shrink. As one MGMA advisor put it: “Integrated platforms turn revenue cycles from chaotic puzzles into predictable engines.”

Actionable Strategies for 2025

- Ditch manual eligibility checks: Tools like Change Healthcare or Epic automate verification, reducing claim rejections by 25%.

- Scrub claims with AI: Kareo’s machine learning spots errors pre-submission, hitting clean claim rates over 95%.

- Live in your dashboard: Monitor denial trends daily with Tableau—top performers resolve issues in under 15 days.

- Upgrade to an all-in-one platform: Cerner or Epic Resolute cuts data entry errors by 50%.

- Audit, train, repeat: Review denials weekly. One clinic found 30% of errors traced back to untrained coders—a fix that saved $2M yearly.

The Bottom Line

In a 55B RCM market racing toward 81B by 2031, standing still isn’t an option. Whether it’s blockchain-secured claims or AI-driven patient payment predictions, the tools exist to turn financial chaos into clarity. Next up: How staff training and denial management complete the puzzle.

CASE STUDY:

Using Epic’s RCM suite, a hospital in the Midwest cut down on accounts receivable (AR) days from 45 to 28 days.

Key RCM Metrics: Track Denial Rates and Net Collection Ratios

Let’s be real: if your revenue cycle were a marathon, KPIs like Days Sales Outstanding (DSO) and net collection rate would be your pacemakers. In 2024, healthcare providers averaging a DSO under 40 days aren’t just surviving—they’re lapping competitors stuck at 50+ days. Take it from HFMA: shaving just 5 days off your DSO can pump up cash flow by 10-15% annually. But here’s the kicker—manual billing systems still drag 63% of practices into the slow lane, burning hours on claim reworks and denial appeals.

A. Financial Metrics

Days Sales Outstanding (DSO):

Think of DSO as your revenue cycle’s pulse. At Mayo Clinic, slashing DSO from 50 to 35 days wasn’t magic—it was AI. By integrating Epic’s automated claim scrubbing, they cut coding errors by 30% and halved payment delays. The result? A 15% cash flow bump that funded new patient tech.

Net Collection Rate:

Top performers like Privia Health hit net collection rates of 95%+ by tackling denials head-on. How? Athenahealth’s real-time eligibility checks flagged insurance mismatches upfront, while staff trained on MGMA’s latest benchmarks reduced appeals from weeks to days. The lesson? A 5% denial rate isn’t “good enough”—it’s $2M lost annually for mid-sized hospitals.

B. Operational Metrics

First-Pass Claim Acceptance Rate:

Ever wonder why Johns Hopkins boasts a 96% first-pass rate? They ditched clunky workflows for Certify Health’s AI-driven claims validator, which cross-checks against 10,000+ payer rules pre-submission. The fix? Fewer “oops” moments and faster payouts—critical when 1 in 5 claims still get bogged down by missing modifiers or outdated ICD-10 codes.

Average Time for Claim Resolution:

Here’s the dirty secret: 70% of denials linger for 30+ days because teams chase ghosts in fragmented systems. Conifer Health’s answer? A blockchain-tracked denial dashboard that prioritises high-value claims. One regional clinic slashed resolution time from 22 days to 9, recovering $850K in stranded revenue quarterly.

C. Case Studies: How Top Hospitals Reduced Denials by 40%

- Epic Systems: Cleveland Clinic’s DSO dropped 7 days post-Epic rollout, with predictive analytics flagging at-risk claims.

- AI Denial Prediction: A Midwest ACO using Waystar’s machine learning tools reduced appeals by 40%—no extra staff needed.

- Real-Time Dashboards: MGMA reports that clinics monitoring KPIs via Tableau cut net collection lag by 12% in 6 months.

“Automation isn’t about replacing people—it’s about giving them superhero tools,” says Priya K., an HFMA-certified RCM director. “When your team isn’t drowning in AR follow-up, they can actually prevent fires instead of fighting them.”

Hybrid RCM Models: Optimising In-House & Outsourced Workflows

Did you know hospitals using hybrid revenue cycle management (RCM) models slash costs by 30% while cutting denial rates to 5.2%? Let’s be real: in 2024, clinging to fully in-house billing is like using a flip phone for telehealth—it works, but you’re haemorrhaging cash and efficiency. Take Coastal Health Network: this 150-provider juggernaut ditched its 45-day AR cycles by blending AI-powered vendor tools with its internal prior auth team. The result? A jaw-dropping $2.1M saved annually and denial rates halve.

A. 2025 Hybrid RCM Models: The Vendor Selection Playbook

Improving revenue cycle management starts with choosing partners that complement your strengths. Here’s how top performers do it:

- AI/ML-Driven Automation:

Tools like Infinx and Fathom Health aren’t just nice-to-have—they’re survival gear. These platforms scrub claims with robotic precision, flagging coding errors before payers spot them. At Coastal Health, Infinx’s real-time eligibility checks reduced claim rejections by 40% in 6 months. - Compliance That Doesn’t Crush Productivity:

Waystar’s blockchain-enabled claims tracking isn’t sci-fi; it’s 2024’s fraud-fighting MVP. Pair this with SOC 2-certified platforms, and you’ve got an audit-proof fortress that even CMS would applaud. - Speciality-Specific Scalability:

Trying to manage DME billing with a generic vendor? Good luck. Hybrid models thrive when vendors speak your speciality’s language—whether it’s RPM codes or oncology prior auths.

“Hybrid models aren’t just cost-saving—they’re sustainability engines.”

— 2024 KLAS Hybrid RCM Report

B. Case Study: Coastal Health’s 94% Net Collection Rate

Stuck with 12% denials and glacial AR cycles, Coastal Health partnered with Guidehouse for claims scrubbing while keeping patient billing inquiries in-house. The hybrid formula?

- Tools: Tableau dashboards tracked KPIs like a hawk, while AI analytics predicted denial risks.

Results: Denials nosedived to 5.2%, and staff productivity jumped 20%—no magic, just smart outsourcing.

C. The ROI Reality Check

Let’s cut through the hype:

| Metric | In-House RCM | Hybrid Model |

| Net Collection | 89% | 95% |

| Cost per Claim | $8.20 | $5.75 |

| Denial Rate | 9.8% | 4.5% |

Hybrid adopters pocket 25–40% higher ROI because they’re not paying staff to chase $8 denials. Want proof? MGMA data shows 18% net revenue growth for hybrids vs. 6% for DIY teams.

D. Your Hybrid Launch Plan

- Pilot First: Test hybrid workflows on your trickiest claims (looking at you, prior auths).

- Demand SLAs: No vendor gets a pass without guaranteeing >90% first-pass acceptance.

- Benchmark Relentlessly: Platforms like Looker expose if vendors are pulling their weight.

Case Study 1: Health System Slashes Denial Rates with AI-Powered Automation

Did you know 73% of hospitals using AI cut denial rates by over 15% in 2024? Let’s be real: manual claims processes aren’t just slow—they’re financial suicide. Take this Midwest health system: after battling an 18% denial rate in oncology billing, they deployed Infinx’s AI-driven pre-registration tools and real-time insurance checks. The result? Denials plummeted to 6% in 18 months, while net revenue for cancer services jumped 24%. How? By auto-verifying patient coverage before appointments and flagging coding errors like missing modifiers.

“We reclaimed 300+ staff hours monthly just by automating eligibility checks,” reported their CFO in a 2024 HFMA case study. The kicker? Their charge capture rate hit 95%—proof that revenue cycle automation isn’t optional in today’s high-deductible world.

A. Clinic Boosts Cash Flow 20% with Patient-Centric Billing

Imagine your clinic losing $50K yearly to clunky billing—then fixing it with two tools. Movement Physical Therapy did exactly this by ditching paper invoices for Tebra’s workflow automation and InstaMed’s payment portal. Patients now get text reminders with one-click payment options, slashing AR days by 10% and boosting collections by $50K annually.

“Transparency built trust—our patient satisfaction scores jumped 35%,” their billing manager told MGMA in 2024. Key move? Upfront cost estimates via InstaMed’s portal reduced “sticker shock” disputes by 40%. Pro tip: Pair automation with staff training on ICD-10 compliance to avoid back-end chaos.

(Psst… this mirrors Mayo Clinic’s playbook—more in our AI strategies section.)

B. Hospital Cuts AR Days 25% with Analytics Overhaul

When Mass General’s AR days hit 45, they turned Tableau dashboards into their secret weapon. By tracking denial patterns in real-time, they prioritized high-risk claims and automated follow-ups via NextGen’s workflow platform. The result? 25% fewer AR days and a 15% net collection rate boost—all without hiring extra staff.

“We spotted 80% of coding errors before submission,” their RCM director noted. The fix? Training coders on modifier 25 requirements while using Looker to benchmark against HFMA’s 2024 KPIs.

C. Tech Vendor Hits 95% Clean Claims with AI “Scrubbers

Here’s the kicker: Waystar proved AI claim scrubbing isn’t hype. Partnering with a 200-provider network, they slashed manual edits by 30% and achieved a 95% clean claim rate using Fathom Health’s NLP coding tools. How? The AI cross-referenced 10,000+ payer rules in real-time—catching mismatched CPT codes faster than human eyes.“Staff now focus on appeals, not data entry,” their VP shared in a KLAS report. For those drowning in denials? Start with automated claim validation—it’s the glue holding modern RCM optimization together.

Make it well-organised; if employees are unable to locate it, it will appear to be nonexistent.

Solution: NextGen Healthcare automates 80% of the work. For more tips, explore our guide to [Is your healthcare revenue cycle costing you money?] or learn [Comprehensive guide on revenue cycle management process] can recover lost revenue.

RCM Best Practices for Sustainable Healthcare Revenue Growth

Did you know hospitals conducting regular audits slash compliance-related denials by 18%? Let’s be real: revenue cycle management isn’t a “set it and forget it” game—it’s a relentless pursuit of precision. In 2024, improving revenue cycle management means adopting practices as routine as a patient’s vital checks but as strategic as a surgeon’s scalpel.

A. Regular Audits: Your Financial Health Check-Up

Think of audits like preventive care for your revenue cycle. Take Intermountain Healthcare: by using Tableau analytics to dissect claims data quarterly, they spotted coding errors costing $2.8M annually. HFMA data backs this up—organisations auditing workflows cut denials by 18% and boosted net collections to 95%. Tools like Epic’s Cogito dashboards make this easier, flagging trends like missing modifiers or ghost AR follow-ups. But here’s the kicker: audits aren’t just about fixing errors. They’re about preventing them. For example, one Midwest clinic reduced prior authorisation denials by 40% after audits revealed staff skipped real-time eligibility checks.

B. Continuous Improvement: The Pulse of Modern RCM

MGMA’s 2024 report nails it: “Monthly KPI reviews are non-negotiable.” Imagine your denial rate spikes to 12% overnight. Without rapid-cycle adjustments—like tweaking claims scrubbing rules or retraining coders on ICD-10 updates—you’re hemorrhaging cash.

Case Study: A Texas hospital slashed AR days from 55 to 32 by holding weekly “data huddles” to review denial root causes.

Action Step: Use AI-driven tools like Waystar to auto-flag KPIs (e.g., Days Sales Outstanding >40).

C. Collaboration: Why Going Solo Fails in 2024

“External expertise isn’t a luxury—it’s survival,” says Dr. Lisa Martin, RCM Director at Intermountain Healthcare. Partnering with firms like R1 RCM or Guidehouse gives access to tools your team might lack, like blockchain for secure claims tracking or AI models predicting patient payment risks.

- Stat: 63% of providers using hybrid RCM models (in-house + outsourced) saw ROI jump 25% in 2024.

- Example: Cleveland Clinic’s collaboration with Experian Health boosted patient collections by 22% using propensity-to-pay scoring.

“The key to sustainable RCM success is a culture of continuous improvement—combining technology, analytics, and expert collaboration to adapt to an ever-changing healthcare environment.”

— Dr. Lisa Martin, Intermountain Healthcare

Conclusion: Turn Revenue Leaks into Cash Flow—Here’s How

Let’s cut through the noise: healthcare revenue optimization isn’t a buzzword—it’s survival. In 2024, clinics drowning in 11.8% denial rates and $262B in billing delays aren’t just inefficient—they’re risking closure. But here’s the good news: the fixes are staring you in the face.

Your Action Plan

- Strangle Medical Billing Errors at Birth: Tools like Epic’s AI claim scrubbers and Fathom Health’s NLP coding catch 95% of errors pre-submission. No more “oops” modifiers.

- Deploy Denial Management Software Like a SWAT Team: Platforms like Waystar and Infinx predict denials before they happen, turning appeals from a 45-day nightmare into a 9-day fix.

- Ditch Paper for Patient Payment Solutions: Text-to-pay portals (InstaMed) and flexible plans boost collections by 20%, because patients pay faster when it’s easier than Netflix.

- Lock Down Insurance Verification Tools: Real-time checks (Athenahealth) slash registration errors by 40%—stop letting expired policies torpedo your cash flow.

The Hard Truth:

The Midwest clinic that cut AR days by 40%? They didn’t have magic—they had urgency. The telepsych group doubling revenue with Doxy.me? They stopped debating and started doing.

Your Move

- This Week: Audit one workflow (hint: start with eligibility checks).

- This Month: Demo denial management software—most vendors offer free trials.

- This Quarter: Train coders on ICD-10 updates (HFMA’s 2024 playbook is gold).

Still drowning? Partner with RCM experts like R1 or Conifer Health. They’ve turned sinking ships into revenue rockets for Mayo and Hopkins—they’ll do it for you.

Final Word: Your EHR isn’t a paperweight. Your staff isn’t a cost centre. And “good enough” billing? It’s a death sentence. The tools exist. The stats don’t lie. The time to act? Yesterday.

👉 Click. Call. Change. Your financial lifeline starts now.

Ready to revolutionise your RCM? Pick one strategy above and run with it. Your CFO (and patients) will thank you.

FAQs: How to Improve Revenue Cycle Management in 2025

What’s the biggest RCM mistake?

Ignoring patient communication. 61% of delayed payments stem from confusing bills.

Should we outsource medical billing?

If denials exceed 10%, yes. Outsourcing costs 3-8% of collections but saves staff time.

How does AI reduce denials?

It acts like a spellcheck for billing, flagging errors pre-submission.

What’s the future of RCM?

Predictive analytics + patient self-service. Think Amazon-style billing: transparent and hassle-free.

What is Revenue Cycle Management (RCM)?

Let’s be real: healthcare’s financial backbone isn’t billing—it’s RCM. Revenue Cycle Management is the end-to-end process hospitals use to track patient care from that first “Hi, I’m here for my appointment” to the final insurance payment hitting the bank. Think scheduling, coding, claims, denials—the whole nine yards. Get this wrong, and you’re leaking cash faster than a sieve. For instance, 34.4% of patient payments slipped through cracks in 2024 due to outdated workflows.

How do you stop claim denials from bleeding revenue?

Imagine your claims as planes—would you let one take off without checking the fuel? Didn’t think so. Here’s the fix:

Tools like Infinx auto-verify insurance before appointments (no more “Oops, they changed plans!”).

AI claim scrubbers (looking at you, Fathom Health) catch coding errors like missing modifiers before submission.

Train staff weekly on denial patterns (Mayo Clinic slashed denials 15% this way).

Pro tip: Audit denial reasons monthly. One clinic found 40% of denials traced back to one coder’s typo—fixed it in a day.

What actually works to boost RCM efficiency?

The secret sauce? Tech + humans.

Epic and Athenahealth automate registration/eligibility checks (cuts errors by 30%).

Dashboards like Tableau spot AR days creeping past 40? Time to chase payers.

Staff training: Coders with AHIMA certs at Mercy Health boosted clean claim rates to 97%.

Real talk: Your EHR’s only as good as your team. One hospital’s “upgrade” failed because staff still used sticky notes for prior auths.

Can tech really save my RCM?

Better question—can you afford not to?

AI predicts denials: Tools like Waystar flag at-risk claims before submission (saves 15 hrs/week on appeals).

Patient portals (InstaMed) let folks pay via text—collections jumped 20% at Johns Hopkins.

Blockchain tracks claims like FedEx packages—no more “Where’s my $2k appendectomy payment?”

Case in point: A Midwest clinic cut AR days from 58 to 32 using Epic’s denial analytics.

What numbers should I obsess over?

Your RCM report card:

DSO (Days Sales Outstanding): Over 40? You’re bankrolling insurers. Target: 35.

Net collection rate: Below 95%? Money’s left on the table. MGMA says top performers hit 97%.

First-pass acceptance: 90 %+ keeps cash flowing.

Hot take: Track “cost to collect”—if you’re spending

10toget

10toget100, something’s rotten.

Do patients really impact RCM?

Ever gotten a bill you didn’t understand? Exactly.

Upfront cost estimates (via tools like MD Clarity) slash disputes by 25%.

Text-to-pay options—patients are 3x more likely to pay if they can Venmo it.

Financial counsellors: Cleveland Clinic’s team recovered $2.8M in self-pay just by explaining bills over coffee.

What’s next for RCM?

2025’s game-changers:

AI denial prediction: Like weather apps for claims—”90% chance Cigna rejects this code.”

Blockchain audits: Prove you billed right without 3-hour payer calls.

Hybrid outsourcing: Use bots for claims, humans for tricky appeals.

Word on the street: CMS might require real-time claims tracking by 2025—get ready.

Should I outsource RCM?

Depends. Solo practice drowning in denials? R1 RCM or Conifer Health can cut AR days by 15%. But vet vendors:

Do they use AI/blockchain?

Can they handle your speciality’s coding quirks?

Transparent reporting or GTFO.

True story: A 10-doctor group saved $300k/year outsourcing—but only after firing their first “cheap” vendor that missed 20% of claims.

Top tools to steal from the pros?

Fathom Health: AI that learns your coders’ habits to prevent mistakes.

PaymentCloud: Patients can split bills over 12 months—collections up 18%.

DrChrono: Telehealth coding that auto-applies POS 02/10 modifiers.

Lifehack: Use Zocdoc for scheduling—it checks insurance while patients book.

How to sleep well knowing auditors won’t wreck us?

Monthly coding audits: Catch errors before payers do.

Compliance software: Think of it as spellcheck for ICD-11 codes.

CMS webinars: Yes, they’re drier than toast, but HFMA says clinics that attend have 50% fewer fines.

Last tip: When in doubt, ask—MGMA’s forums saved one CFO from a $200k oopsie.

Telehealth billing hacks for 2025?

POS 02 vs. 10: Home visit? POS 10. Clinic-to-home? POS 02. Mix them up, and kiss $ goodbye.

Modifier 95: Forget this on synchronous visits, and you’re working for free.

DrChrono’s telehealth suite: Auto-attaches visit recordings to claims—denial-proof your docs.

War story: A telepsych group doubled revenue using Doxy.me’s built-in billing check