Comprehensive Guide to the Revenue Cycle Management Process | Elitemed Financials

Table of Contents

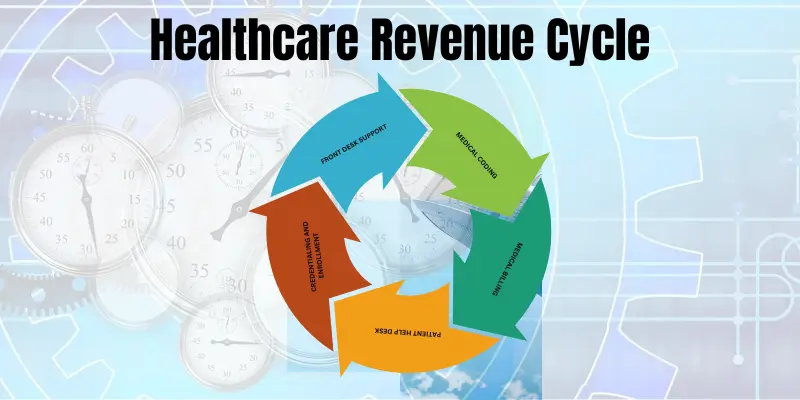

Key Steps in the Revenue Cycle Management Process

An Effective Revenue Cycle Management process consists of steps that track patient care episodes from pre-registration to the final balance payment to ensure that healthcare providers receive prompt payments for the services provided. These steps help healthcare providers maximize revenues by streamlining operations and decreasing claim denials. This article will explore the key steps of the Medical Billing process in more detail. Each step significantly ensures that healthcare providers or doctors are reimbursed precisely and effectively.

Why Revenue Cycle Management (RCM) Matters

Revenue Cycle Management (RCM) is the financial backbone of healthcare. A well-optimized RCM process ensures that providers are paid accurately and promptly for services rendered. According to MGMA, inefficient RCM costs up to 15% of annual revenue due to claim denials and billing errors.

7 Key Steps In The RCM Process

1. Patient Registration and Scheduling

The revenue cycle management starts with the appointment scheduled by the patient. This step is crucial as a little mistake can lead to future administrative errors. It is vital to accurately collect patient information like personal details, contact numbers, other information, and insurance-related data. Insurance details are necessary and crucial to check that the patient’s insurance is valid and will cover the scheduled service. The accurate information related to insurance coverage and the verification process prevents delays in future payments and claim denials.

Data to Collect:

- Name of patient

- Demographic details of the patient

- Medical history pertinent to the patient or the purpose of the visit

- Information about insurance

- Details of billing

Importance of Patient Engagement and Data Accuracy

To avoid administrative errors and ensure accurate billing, Patient engagement and patient data accuracy are important.

- Patient engagement: early engagement of the patient helps in collecting complete and error-free information

- Patient Data Accuracy: Patient data should be accurate, and effectively captured to avoid claim denials and billing errors.

Pro Tip:

Use AI-powered tools like Zocdoc to automate scheduling and reduce no-shows by 40%.

2. Insurance verification and appointment Scheduling

Verifying insurance coverage and eligibility before the patient arrives for an appointment is very important for healthcare providers. This will help the caregivers to confirm that the specific medical service is covered in the patient’s insurance plan. And whether he is eligible for the scheduled service.

Check:

- Eligibility status

- Pre-authorization requirements

- Deductibles & copays

Why It Matters:

- Prevents claim denials due to eligibility gaps.

- Reduces patient disputes over uncovered services.

Pro Tip:

Integrate real-time eligibility tools like Waystar to slash denials by 25%.

3. Charge Capture

Charge capture is related to all billable services rendered to a patient. Accurate charge capture is mandatory to ensure there is no underbilling or missing service which can result in lost revenue. Charges for anticipated treatments for each patient must be recorded on a claim, which is then sent to the patient’s insurance provider or health plan. This is an important step that verifies the charges’ accuracy and the method by which your healthcare organization will be reimbursed in the end. After the charging process, the billing procedure starts. With the help of coded data healthcare providers generate claims which they send to the patient’s insurance company for payment. The precise and unambiguous claims reduce the possibility of rejected or declined claims.

Avoid

Record all billable services to avoid underbilling. Use:

Tools

- EHR-integrated charge entry systems

- Real-time scrubbing for errors

Case Study

- A Midwest clinic reduced missed charges by 90% using automated charge capture.

- Missing charges = lost revenue.

- Ensures compliance with payer rules.

4. Medical Coding & Documentation

This action needs to be taken by the patient’s health plan or insurance provider. At this point, they review the scheduled services’ medical needs. You will receive the information back from the insurance provider when it has decided whether to pay for these services for this patient.

Procedures need to be coded into billable charges once the insurance provider has verified coverage and the procedure has occurred. Each procedure has a billing code, and coders are skilled at converting the patient’s treatment record’s documented procedures into these billable codes. Bills and claims for payment are subsequently generated for the patient using the codes.

Compliance Alert

Convert treatments into billable codes (CPT, ICD-10). Partner with AAPC-certified coders to:

- Avoid coding errors (cause 40% of denials).

- Maximize reimbursements with precise documentation.

Best Practices:

- Audit charts for specificity (e.g., “Type 2 diabetes with foot ulcer” vs. “diabetes”)

- Use NLP tools like 3M CodeRyte for accuracy.

- Clean coding = faster claim submissions.

5. Claim Submission

The next stage is to submit the prepared and coded claims to the payors, who are the patient’s insurance company or health plan. After reviewing the claim, the payor will check for any mistakes or discrepancies with the previously authorized methods. In this stage, it will be decided whether the claim will be denied or paid. Two important aspects in this stage are as follows

Goal:

Achieve a 98% clean claims rate.

Key Aspects of Claim Submission

- Understand the reasons behind the rejection of the claim and how to address them

- Use technology to update claim submission and settlement.

Tools:

- Claims scrubbing software (e.g., Change Healthcare)

- Payer-specific rule engines

Stat:

- Practices using automated claim submission resolve denials 50% faster.

- 98% first-pass acceptance rate with real-time tracking.

- Reduces A/R days by 30%.

6. Remittance processing and payment posting

Your information regarding the amount that will be compensated for the claim is sent to you by the payor after it has been processed. The claim payout may be delayed if inconsistencies or inaccuracies are found. Should mistakes be discovered, the claim must be resubmitted. You can charge the patient for any remaining patient responsibility amount by delaying the payor’s payment until after you resubmit. To make sure you are not missing any payments, you should regularly review your remittances.

Steps must be taken here

- To maintain cash flow, delays in payment posting must be addressed

- Remittance must be reconciled with payments.

Reconcile payments with remittance advice (ERA/EOBs). Steps:

- Identify underpayments/denials

- Post adjustments/patient balances

Pitfall:

- Manual payment posting causes 8% of errors (per HFMA).

- Flag issues for A/R follow-up.

Automate:

- ERA/EOB reconciliation

- Denial tracking (e.g., Athenahealth)

7. Patient billing and collection

After the payor has been paid, you need to figure out how much is still owed on the account and whether the patient still has any obligations. This is frequently one of the most difficult phases to finish for certain firms. It’s important to send out statements on time since the sooner you do so, the sooner you can expect payment. To collect payments from patients who still owe money, monitoring outstanding accounts is another aspect of collections. As patient deductibles rise, this step becomes even more crucial. The patient is bearing a greater portion of the cost of rendered services. Give the patient enough notice when payments are due by being transparent about your business’s fees and schedules.

Your healthcare organization’s success depends on how successfully you manage this cycle. You will see more patients and gather more data as your company expands. There is an increased risk of error and loss while handling a larger volume of data. Either you have a staff dedicated to revenue collection, or you have one individual doing this task alone, depending on the size of your firm. Securing reimbursement from patients and insurance for your important services is contingent upon your ability to pay attention to each phase in the medical revenue cycle management process.

Bill patients promptly for residual balances. Use:

- Multi-channel patient statements (mail, SMS, email)

- Compassionate follow-ups for overdue accounts

Trend:

Patients now pay 35% of healthcare costs out-of-pocket.

Strategies:

- Offer payment plans via platforms like PayPal Health.

- Send SMS payment reminders (improves collections by 60%).

Why Optimize Your RCM?

- Reduce Denials: Fix root causes with denial management audits.

- Boost Cash Flow: Accelerate reimbursements by 30%.

- Improve Compliance: Stay audit-ready with HIPAA-trained teams.

To learn more about how to optimize and improve efficiency, we already cover it in our article” how organizations can improve healthcare revenue cycle management”

“EliteMed’s RCM process cut denials by 50% for Metro Urgent Care. Schedule a free audit to see how we can help!”

FAQs About Revenue Cycle Management

What’s the #1 cause of claim denials?

Incorrect patient data (e.g., typos in insurance ID numbers). Fix this with automated eligibility checks.

How can technology improve RCM?

Tools like AI-powered coding and robotic process automation (RPA) reduce errors by 40% and speed up payments.

Should I outsource RCM?

Yes, if your denial rate exceeds 5% or A/R days are over 40. EliteMed’s teams maintain 98% clean claim rates.

How do I improve patient payment collections?

Offer flexible payment options (credit cards, PayPal).

Train staff in compassionate communication (e.g., HFMA’s Best Practices).

About the Author

Omer Farooq is a Certified Healthcare Financial Professional (CHFP) with 12+ years of experience optimizing RCM workflows for hospitals and clinics. He has contributed to industry journals like Healthcare Financial Management and trains teams on HIPAA-compliant billing practices.